Small business budget: As a small business owner, reliable budgeting is important for the success and development of your endeavor. With minimal resources and countless expenditures to handle, developing a well-structured budget plan can aid you in maintaining monetary security, making good choices, and overcome the difficulties of running a small company. In this extensive short article— We’ll discover helpful budgeting tips that can equip small business owners to take control of their funds and lead the way for long-lasting productivity.

What do you mean by a Small Business Budget Plan?

A small company budget plan is a thorough monetary plan that details your awaited earnings and expenditures over a specific duration.

A small company budget plan is a thorough monetary plan that details your awaited earnings and expenditures over a specific duration. It works to assign sources to properly determine possible shortages or excess and make good choices concerning financial investments, expenses, and monetary supervision.

A well-crafted small company budget plan takes into consideration different variables consisting of predicted sales functional expenses, advertising and marketing expenditure, staff member settlement, tax obligations and also financial obligation payment. It assists you in envisioning the economic landscape of your business allowing you to prepare for future difficulties.

Why are Budgets Important for Small Business ?

For small company owners, creating and adhering to a well-planned budget plan is critical for lasting success. A budget plan functions as a monetary roadmap that leads company choices and guarantees reliable source allocation.

Right here are some important reasons why the budget plans are crucial for small companies:

Cash Flow Management

One of the main difficulties small companies encounter is preserving a healthy and balanced capital. A budget plan aids track inbound together with outward bound expenditure permitting company owner to prepare for and get ready for prospective cash lacks.

By anticipating future expenditures, business owners can choose when to save sources or look for extra financing.

Cost Control

Operating a small business commonly indicates collaborating with restricted sources. A budget plan functions as a cost-control tool, making it possible for company owners to recognize locations of overspending along with carrying out cost-cutting actions where essential. This degree of economic understanding can avoid unneeded expenditure and also optimize productivity.

Prioritizing Expenses

With a clear allocation, small company owners can focus on their expenditures based on their effect on company procedures and development. Necessary expenditures, such as rental fees, energy, and staff member wages, can be made up while non-essential expenditures can be examined and possibly lowered or removed.

Investment Planning

Small companies frequently look for opportunities to reinvest their money in development, advertising, marketing, or new item advancement. A well-structured budget plan provides insight into the readily available funds for such financial investments, enabling owners to make good choices regarding the usefulness and timing of these campaigns.

Exploring business funding can also give them the flexibility to pursue growth without putting too much strain on their existing resources.

Financial Transparency

Budgets advertise monetary openness within the company. By entailing essential staff members in the budgeting procedure, everybody can much better comprehend the economic purposes and add to accomplishing them. This openness cultivates a feeling of responsibility together with urges for cost-conscious habits throughout the company.

Securing Financing

When looking for outside funding from lending institutions or capitalists an extensive budget plan shows monetary obligation and also boosts the opportunities of getting desirable terms. Lenders and also capitalists are most likely to count on companies that have a strong understanding of their economic scenario and a clear preparation for handling sources.

Tax Planning

Accurate budgeting aids small companies to prepare for tax obligation responsibilities together with staying clear of pricey charges or passion expenditure. By tracking expenditures and earnings throughout the year, company owner can make notified choices concerning tax obligation methods and also guarantee they have enough funds reserved to satisfy their tax obligation responsibilities.

Contingency Planning

Unforeseen situations such as financial declines, supply chain disturbances or adjustments in guidelines can dramatically influence a small company’s procedures. A properly designed budget plan needs to consist of backup funds to cushion the influence of such occasions along with supply economic durability throughout tough times.

How to Create a Budget?

Whether you're attempting to conserve for a large acquisition, settle financial obligations or merely handle your expenditure better, a well-planned budget plan can be an effective tool.

Collect Your Financial Information

Begin by collecting all the essential monetary details consisting of pay stubs, financial institution declarations, bank card expenses, and any type of various other documents associated with your earnings and also expenditures. Having a clear understanding of your present monetary scenario is essential for producing an exact and reasonable budget plan.

Determine Your Income

Checklist all income resources, including your wage, any kind of side rushes, financial investment revenue or any kind of various other income sources. Make certain to utilize your earnings (after tax obligations together with reductions) for the most exact photo.

Track Your Expenses

This action is vital for comprehending where your cash is going. Separate your expenditure right into 2 classifications: taken care of expenditure (lease home loan repayments, insurance coverage expenditure and so on) along with variable expenditure (groceries, amusement, transport and so on). Testimonial your financial institution and bank card declarations for the previous couple of months to obtain a clear image of your investing behaviors.

Prioritize Your Expenses

When you have a thorough listing of your expenditure, focus on them based on their relevance. Important expenditures, such as real estate, energy, and also grocery stores must go to the top of the listing, adhered to by optional expenditure like amusement together with dining in restaurants.

Set Financial Goals

Identify your monetary objectives whether it’s conserving for an emergency fund, settling financial debt, or conserving for a considerable acquisition. Assign a section of your allocation attaining these objectives and also treat them as vital expenditure.

Develop a budget plan

With your revenue, expenditure, and monetary objectives in mind, develop a budget plan that lays out how you will certainly designate your revenue to various groups. Use a budgeting tool, spreadsheet, or application to assist you in arranging and tracking your investing strategy.

Construct a Buffer

Life is uncertain along unanticipated expenditure can emerge at any moment. Construct a barrier or emergency fund to allocate these shocks such as cars and truck repair works, clinical expenditure or residence upkeep.

Readjust and Optimize

Your budget plan is not uncompromising. Evaluation and readjust it frequently to show modifications in your revenue, expenditure or economic objectives. Seek locations where you can reduce unneeded investing and also reassign those funds in the direction of more crucial concerns.

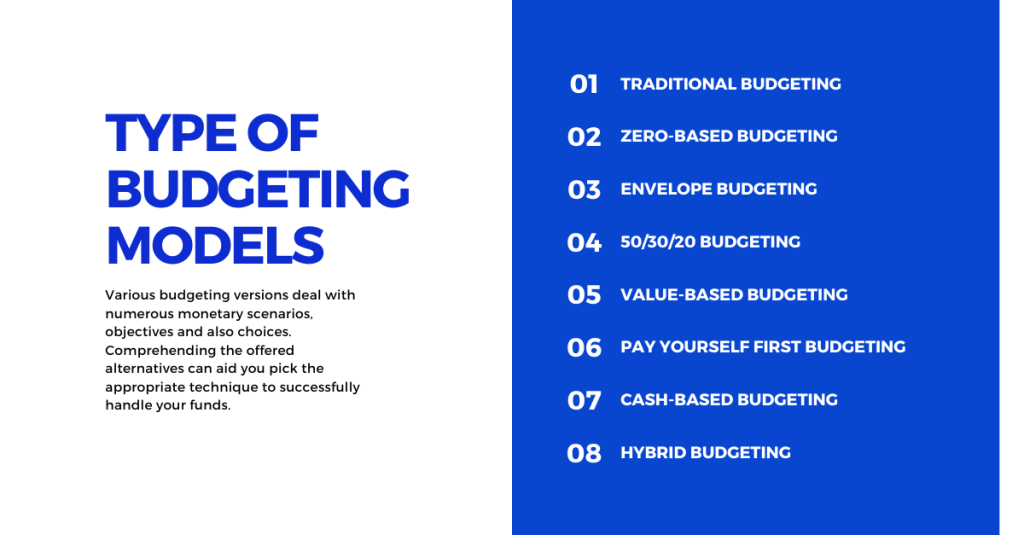

Type of Budgeting Models

Various budgeting versions deal with numerous monetary scenarios, objectives and also choices. Comprehending the offered alternatives can aid you pick the appropriate technique to successfully handle your funds. Below are a few of one of the most prominent budgeting models:

Traditional Budgeting

- It is one of the most straightforward and extensively used budgeting techniques.

- It involves providing all resources of earnings and subtracting taking care of also variable expenditures.

- Allows you to set aside funds for various groups like real estate, transport, and home entertainment

- Suitable for those that favor a straightforward, structured strategy

Zero-Based Budgeting

- Starts from a fresh start, presuming no expenditure or earnings

- Requires allowing every buck of revenue in the direction of particular expenditure or financial savings objectives

- Promotes conscious expenditure along with getting rid of unneeded expenditures

- Ideal for those who wish to take full advantage of financial savings along with reducing waste

Envelope Budgeting

- It involves allowing money right into assigned envelopes for various cost groups

- Helps envision and manage expenses by literally dividing funds

- Suitable for those who choose a hands-on cash-based technique

- Encourages self-control and avoids overspending in certain locations

50/30/20 Budgeting

- Allocates 50% of revenue in the direction of crucial expenditure (real estate, energy, groceries).

- 30% for optional expenditure (amusement, eating in restaurants, pastimes).

- 20% for cost savings and also financial debt payment.

- Provides a well-balanced method for those with secure earnings streams.

Value-Based Budgeting

- Focuses on straightening expenditure with individual worths and top priorities.

- Involves classifying expenditure based on their value or effect on life objectives.

- Suitable for those who intend to focus on expenditure on what matters many.

- Encourages conscious decision-making and aids prevent crazy investing.

Pay Yourself First Budgeting

- Prioritizes conserving or spending a section of revenue before allocating funds for expenditure.

- Promotes the practice of conserving continually and structuring a wide range with time.

- Suitable for those with long-lasting economic objectives such as retired life or significant acquisitions.

- Helps guarantee cost savings are not ignored for optional expenditure.

Cash-Based Budgeting

- It involves using cash for all deals and staying clear of debt or debit cards.

- Promotes aware expenditure and also avoids overspending.

- Suitable for those who battle with impulse acquisitions or overspending with plastic.

- Self-control and preparation are required to make particular cash available.

Pro tips to create a small business budget

Begin with a Realistic Revenue Forecast

Accurately predicting profits is the keystone of a reliable budget plan. Start by assessing your previous sales information, considering variables such as seasonality, market patterns, and consumer actions.

Research and study your sector and rivals to gain an understanding of possible development chances or obstacles. In addition, consider any prepared advertising projects, item launches, or developments that might influence your profit forecasts.

When approximating profits, it’s typically suggested to be conservative to avoid overspending. Overestimating profits can lead to excessively enthusiastic investing plans, possibly leading to economic pressure if the forecasted earnings stop working to materialize.

By being reasonable and erring on the side of caution, you can create a barrier to soak up unanticipated variations in sales or market problems.

Identify Expenses

Classifying expenditures right into taken care of together with variable classifications is essential for reliable budgeting. Repaired expenditures such as lease, insurance coverage, finance payments, and specific energy expenditures continue to be continuous, regardless of your service’s sales quantity or task degree.

Variable expenditures, on the other hand, change based on your organization’s functional requirements and sales demographics. They consist of stock prices, advertising, marketing, advertising expenditures, delivery and shipment fees, and compensations paid to sales employees.

By dividing expenditures into these 2 groups, you can better comprehend the effect of adjustments in sales quantity on your general expenses.

This understanding allows you to recognize areas where expense financial savings might be feasible, especially for variable expenditures, which can be changed based on your company’s efficiency.

Prioritize Essential Expenses

Not all expenditures are produced equally. It’s crucial to compare important and non-essential expenditures. Necessary expenditures are those that are essential to the procedure and the development of your company, such as rental fees or home loan settlements, energy staff member earnings advantages, supply prices, and important tool upkeep.

Non-essential expenditures, while possibly valuable, are not always essential to the core procedures of your company. These might include memberships, expert subscriptions, enjoyment expenditure, or high-end workplace upgrades.

While non-essential expenditures can offer worth, they must be very carefully examined and minimized or removed if essential to guarantee your budget plan continues to be straightened with your service top priorities.

By focusing on significant expenditures, you can guarantee that your most crucial functional demands are fulfilled even during times of monetary stress. This technique assists you in designating sources successfully and preserving the monetary security needed for lasting success.

Execute Cost-Cutting Measures

Routinely examining your expenditure is essential to recognize where expense financial savings can be accomplished without endangering the top quality of your service or products.

Begin by analyzing you’re dealt-with and also variable expenditures very closely, seeking chances to minimize and even get rid of unneeded expenses.

To manage expenditures, consider renegotiating agreements with suppliers, seeking more affordable providers, or settling solutions to take advantage of quantity price cuts.

For variable expenditures, assess your stock monitoring procedures, investigate more reliable manufacturing techniques, or maximize your advertising and marketing methods to optimize ROI.

Furthermore, review your functional procedures and try to find possibilities to enhance processes, automate repeated jobs, or outsource non-core tasks to more economical service providers.

Tiny modifications in numerous locations can amount to considerable expense financial savings in time.

Built in a Backup Fund

Unforeseen expenditures are an unpreventable component of running a company. From tools malfunctions to lawful charges or momentary team lack of unpredicted prices can rapidly hinder also one of the most meticulously crafted budget plans.

To reduce the influence of such occasions, it’s essential to develop a backup fund within your budget plan.

A backup fund is a specialized fund reserved to cover unexpected expenditures. The size of this fund will certainly depend on your service’s size, market, and threat account. Normally, allowing between 5% and 10% of your general allocation to a backup fund is a sensible starting point.

With a backup fund, you can weather monetary tornados without interrupting your core procedures or endangering your capital. This fund gives economic padding, enabling you to react rapidly to unexpected difficulties and decreasing the demand for anxious cost-cutting steps or handling added financial debt.

Take Advantage Of Technology

In today’s digital age innovation can be an effective ally in enhancing procedures minimizing labor expenses and also boosting general performance. Buying the best innovation and automation tools can generate substantial price financial savings for your small company.

Cloud-based software program services, for example, can assist you handle different facets of your company, from bookkeeping along with payment to task administration and also Customer Relationship Management (CRM Tools). These tools raise performance and minimize the requirement for pricey -property equipment and devoted IT personnel.

Furthermore, consider carrying out automation tools for repeated jobs, such as information entrance, stock administration or consumer interaction.

By automating these procedures, you can maximize beneficial time and sources that can be rerouted towards even more critical campaigns.

While the preliminary financial investment in innovation might appear to be discouraging, the lasting expense of financial savings and also performance gains can exceed the ahead-of-time expenditure, making it a beneficial financial investment for small businesses looking to enhance their budget plans and procedures.

Screen and Adjust

Budgeting is not a set-it-and-forget-it exercise. Your budget plan ought to be a living document that progresses with your organization. Frequently checking and readjusting your budget plan is essential to guarantee its significance and performance.

Allotted committed time each month or quarter to examine your real monetary efficiency versus your forecasted budget plan. Assess differences between your anticipated and real numbers, determine locations where you might have taken too lightly or overestimated expenditure, and make essential modifications to your budget plan.

If you see significant variances from your estimates, explore the underlying reasons and identify whether these discrepancies are momentary or a measure of a better pattern. Based upon your searchings, readjust your budget plan appropriately to mirror the brand-new truths of your service.

Consistently tracking and changing your budget plan permits you to remain active along with adjustments in your market, market problems, or service procedures. It additionally permits you to proactively attend to prospective concerns before they rise into even more substantial monetary obstacles.

Look For Professional Advice

While budgeting might appear simple, it can rapidly become complicated, especially as your company expands or deals with unique economic obstacles. In such circumstances, seeking assistance from a specialist accounting professional or economic expert can be very useful.

Specialist consultants bring specialized expertise and experience to the table, supplying unbiased understandings and suggestions customized to your company’s particular demands. They can assist you in creating an extensive budget plan that represents numerous variables, such as tax obligation effects, governing conformity, and industry-specific factors to consider.

Furthermore, experts can give critical advice on enhancing your monetary techniques, recognizing possible locations for price financial savings or earnings development, and making sure that your budget plan aligns with your total company objectives and lasting vision.

While expert solutions might incur extra costs, the prospective advantages of professional support, threat reduction, and good decision-making can far surpass financial investment, especially for small companies navigating intricate monetary landscapes.

Projection Cash Flow

Capital is the lifeblood of any small company, and efficient cash-money management is crucial for maintaining monetary security. While your budget plan might reveal healthy and balanced profits, an absence of available money can impede your capability to fulfill everyday functional expenditures, pay suppliers, or buy development possibilities.

To prevent cash circulation concerns, it’s important to forecast your money inflows and discharges routinely. Assess your balance dues and payables, anticipate any considerable future expenditures or financial investments, and determine possible money spaces or excesses.

Consider determining steps to boost capital, such as providing rewards for very early repayments, bargaining longer repayment terms with suppliers, or discovering different funding alternatives like credit lines or billing factoring.

Routine capital projecting enables you to proactively resolve possible capital obstacles guaranteeing that you have the required funds to satisfy your responsibilities and benefit from development possibilities as they develop.

Apply a Purchase Approval Process

Carrying out an acquisition authorization procedure can aid you preserve much better control over your expenditure and also protect against unneeded or unapproved acquisitions. This procedure includes developing clear standards and methods for accepting acquisitions within your company.

Begin by assigning particular people or functions to authorize acquisitions within established investing restrictions. This might entail establishing various authorization degrees based on the acquisition’s worth or classification.

Establish a standard acquisition requisition that captures all appropriate information, such as the product or solution being asked for, the anticipated price, the business reason, and the expected advantages or ROI.

Apply the authorization procedure continually, guaranteeing that all acquisitions, despite their dimension or nature, adhere to the well-known procedures. This method not only aids you in maintaining financial self-control but also advertises liability and openness within your company.

By applying an acquisition authorization procedure you can minimize the danger of overspending, make sure that acquisitions straighten with your service purposes, and preserve far better control over your budget plan.

Take Advantage Of Accounting Software

Accountancy software programs can be an effective tool for small business owners aiming to enhance their budgeting and monetary administration procedures. These software programs supply a variety of functions and capacities that can streamline accounting systems, automate monetary coverage, and give your company a real-time understanding of your monetary efficiency.

The audit software application permits you to quickly track revenue and expenditure, categorize purchases, and create thorough economic records with just a couple of clicks. Several software program services likewise use budgeting components that allow you to produce and keep track of budget plans, contrast real efficiency versus forecasts, and recognize incongruities or areas for improvement.

Furthermore, cloud-based bookkeeping software program options provide the advantage of availability, permitting you to access your economic information from anywhere at any time and work with your accounting professional or monetary consultant much more effectively.

Carry Out Regular Financial Reviews

Performing routine economic evaluations is important for monitoring your organization’s monetary efficiency and guaranteeing that your budget plan stays appropriate and aligned with your objectives.

Allot committed time every month or quarter to examine your monetary declarations, including your revenue declaration annual report, along with the capital declaration. Assess vital economic metrics, such as success proportions, liquidity proportions, and also debt-to-equity proportions, to obtain an understanding of your organization’s monetary wellness.

Throughout these evaluations, contrast your real monetary efficiency versus your budget plan forecasts and recognize any substantial incongruities. Explore the source of these incongruities and establish whether they are momentary changes or a sign of wider fads that might call for modifications to your budget plan or service methods.

Furthermore, utilize these economic evaluations to reassess your service objectives, market problems, and market fads. Based upon these elements, modify your budget plan to guarantee it continues to be straightened with your advancing service demands and goals.

Think About Outsourcing Bookkeeping with Accounting

As a small company owner, your time and power are useful resources that should be concentrated on core service tasks and tactical campaigns. Bookkeeping and accountancy jobs, while vital, can be lengthy and might interfere with your capability to focus on revenue-generating tasks or company development.

Outsourcing your bookkeeping and accountancy operations to a specialist provider can be economical and practical in such situations. Outsourcing permits you to take advantage of the experience of competent specialists who concentrate on monetary administration, making precise and up-to-date monetary documents without the requirement to employ them with an in-house bookkeeping group.

Final Thoughts

By implementing these tips, you can maximize your time and concentrate on driving your organization onward. While profiting from the competence together with the performance of skilled specialists. Furthermore, the price of implementing might be a lot more convenient than keeping an internal bookkeeping division specifically for small companies with minimal sources. This can effectively manage your small business budget.

By applying these additional budgeting tips, small business owners can strengthen their economic administration techniques, gain better control over their expenditures, and position their companies for long-lasting success.

FAQs

Budgeting plan is vital for small companies since it helps to handle capital, control expenses, prepare for future expenditures and make good monetary choices. With restricted sources a well-planned budget plan makes certain to decrease the threat of spending beyond your means and tackle economic problems.

To develop a precise budget plan begin by tracking your earnings and also expenditures carefully for at the very least 3 months. Categorize your expenditure right into deals with prices (lease, energies, wages) and also variable prices (materials, advertising and marketing and so on). Following, examine your historic information to anticipate future earnings and expenditure. Ultimately established reasonable monetary objectives.

Some typical budgeting challenges consist of taking expenditures too lightly, stopping working to make up uneven or seasonal expenditures, overlooking to allocate tax obligations and also insurance policy. Along with that not leaving space for backups or emergency situations. It’s likewise crucial to stay clear of extremely positive profits estimates which can bring about overspending.

To guarantee your small business stays with the budget plan principals in the budgeting procedure to promote buy-in as well as responsibility. Consistently evaluation together with readjustment of the budget plan as required. Along with that carry out cost-control procedures when essential. In addition, think about utilizing budgeting software applications or applications to track expenditures in real-time. And also obtain signals when you’re coming close to or surpassing your budget plan limitations.

If your local business goes over the planned budget it’s critical to recognize the origin. Are your income projections too ambitious? Are there certain cost classifications where you’re spending beyond your means? As soon as you identify the concerns, take rehabilitative activities such as reducing non-essential expenditure, renegotiating agreements, or discovering methods to enhance profits.