AI Tools for Stock Market Analysis: For so long, the stock market has been an extremely intricate and dynamic environment—one that made many seasoned investors wonder just how hard it was. It is in the application of artificial intelligence in financial analysis over the past decades that very serious changes have been made in how traders and investors face the marketplace.

AI stock market analysis tools put advanced algorithms, machine learning, and big data into action to provide insights previously unattainable with traditional methods.

Through AI, investment can be decided to be done in more rational places and quantities, opportunities can be discovered much earlier, and risks relating to investment can be mitigated far before they pose threats.

With rapid variations in the financial world, these 10 Best free AI tools for Stock Market Analysis today are important to gaining leverage over others in the stock market.

What are AI Tools for Stock Market Analysis?

These free AI tools for stock market analysis are software and platforms that make use of artificial technologies in financial data analytics to predict the trends in the marketplace for supporting investment decisions.

These tools apply different AI techniques, including machine learning, natural language, and deep learning, in the crunching of vast volumes of data from variant origins like financial statements, news articles, social media, and market indicators.

Advanced versions can be used for:

1. Pattern recognition: Find out recurring trends and patterns in stock price movements and trading volumes.

2. Sentiment analysis: Determine the sentiment of markets from news articles, social media posts, and other text data.

3. Risk assessment: Review all possible risks that may be caused by certain stock or sectors in the market.

4. Predictive modeling: Provide a view of future stock prices and trends in the market instead of guessing based on past data and conditions.

5. Portfolio Optimization: This includes sets of asset allocation strategies that must be optimal concerning the tolerance of an investor for risk and financial goals.

Why You Should Use AI Tools for Stock Market Analysis

Artificial intelligence has turned out to be a game-changer in the world of stock market analysis, making it quite advantageous compared to traditional approaches. Here are compelling reasons to use free AI tools for stock analysis in investment strategy:

1. Improved Capabilities in Data Processing

AI tools can process huge amounts of data at incredible speeds, way beyond that of the human brain. They bring together financial statements, market trends, news articles, and social media sentiments in real-time to provide a holistic view of the market landscape, thereby making an investor better positioned to make investment decisions based on various parameters.

2. Patterns and Trends Identification

AI algorithms can identify complex patterns and trends, which are not easily perceptible to the human eye. Such tools make use of historical data and understanding of the present market to detect any potential trading opportunities and predict future market movements more accurately than traditional methods of analysis.

3. Emotion-Free Decision Making

Human emotions often prevail, especially concerning irrational investment decisions, more so at times of market volatility. AI tools remove such emotional bias through objective analysis solely based on data and predefined criteria. This will help investors avoid common pitfalls like panic selling or FOMO buying.

4. Real-Time Analysis and Alerts

AI-equipped tools give an investor the ability to monitor markets throughout the day, 24 hours at a stretch. It provides the investor with real-time analysis and instantaneous alerts of major events and changes transpiring in the marketplace.

This relentless monitoring provides the investor with the capability to immediately respond to new information that could either enable them to seize an opportunity or mitigate some risk factor ahead of the market’s reaction.

5. Personalized Investment Strategies

AI investment products are, therefore, increasingly being designed to provide personalized investment advice that best meets an investor’s tolerance, financial goals, and desired investment preferences. This approach will ensure that a much more effective strategy is tailored to each particular need and objective.

6. Backtesting and Scenario Analysis

Such tools can repeatedly emulate any possible market situation using historical data to backtest exactly every trading strategy. This facilitates the reworking of strategies and realization of possible outcomes by investors before putting real money at stake, thus alleviating the risk and making informed decisions.

How to Use AI Tools for Stock Market Analysis

Although AI tools are powerful, the bottom line is to be able to use them effectively to get the full potential power out of them. Here’s how to put AI tools into your stock market analysis:

1. Define Your Investment Goals and Strategy

Before working with AI instruments, identify your investment objectives, risk tolerance, and style of trading. This will help in the right choice of the most appropriate AI tools and tuning them for your investment strategy.

2. Choosing the Right Tools

Provide access to the right tool of AI regarding one’s needs. Check the kind of analysis offered, user-friendliness, integration with platforms already run, and costs. Focus on a few important ones rather than all together.

3. Note the methodology adopted by the Tool

Know what each AI tool does: its sources, how it analyses data, and the limitations involved. Such knowledge should put you in a position to interpret results better and thus avoid being overdependent on any one tool.

4. Integrate AI Insights with Fundamental Analysis

Remember: AI tools must not replace the good old fundamental analysis. Use the AI insights as another source to aid in your own research and due diligence. This could help in making stronger investment decisions.

5. Begin with Paper Trading

Before live deployment with real capital, start with the use of AI tools through paper trading or demo accounts. This allows the users to get used to the tools and to be able to see whether they are effective, or not, without succumbing to financial hazards.

6. Continuously Monitor and Optimize

Keep looking into the performance of AI-assisted strategies. Be prepared to make changes in your approach as the market conditions change or you do not get the expected result from tools.

Top 10 AI Tools for Stock Market Analysis

Here is the list of top free AI tools for stock market India:

1. TradingView

It is the top AI based stock trading tool in India. TradingView is an all-one charting with a social network for traders and investors. It joins forces advanced technical analysis tools with AI insights that, together, provide very informed trading decisions. The tool includes real-time data, custom charts, and a rich library of technical indicators.

AI on TradingView conducts pattern recognition, automated technical analysis, and sentiment analysis of news items and social media regarding finances.

The infrastructure it uses is cloud-based and gives users the ability to access charts and analysis from any device, hence offering software flexibility for both newbies and pros in trading.

Key Features

- AI-powered identification of patterns and performing technical analysis.

- Social networking and idea sharing amongst traders

- Custom charting with more than 100 technical indicators

- Real-time data and alerting, across different asset classes

Pros:

- A user-friendly dashboard for both new and professional investors

- Huge community to share ideas and strategies

- Fully-fledged charting with AI-powered pattern detection

Cons:

- More professional offerings are available only with the paid subscription

- Service may be overwhelming in the case of absolute beginners

- Integration with some brokers is limited for direct trading purposes

Website: www.tradingview.com

2. StockRover

Stock Rover best AI stock analysis tool. It is a platform with AI-based enhancements for stock research and portfolio administration, designed for serious investors—expect fundamentally deep analytics supported by technically rich analytics, from which Stock Rover offers AI-driven stock screening and ranking.

The platform pulls out data from a wide range of sources and uses algorithms under machine learning. It measures portfolio performance and keeps you up to date with market trends of potential investment opportunities through its AI tools.

Its strong screening features enable the filtering of stocks on hundreds of metrics, thereby making it a very useful tool for value investors and quantitative analysts.

Key Features:

- AI-powered stock screening and ranking system

- A strong set of fundamental and technical analysis tools

- Portfolio management with performance analysis

- Automated alerts and reports of portfolio and watch list stocks

Pros:

- In-depth research capabilities, enhanced with AI-driven insights

- Excellent data visualization and reporting tools

- Strong Component of Fundamental Analysis for Long-Term Investors

Cons:

- New users face a steep learning curve

- Very limited real-time data available on lower-tier plans

- Primary markets focused

Website: www.stockrover.com

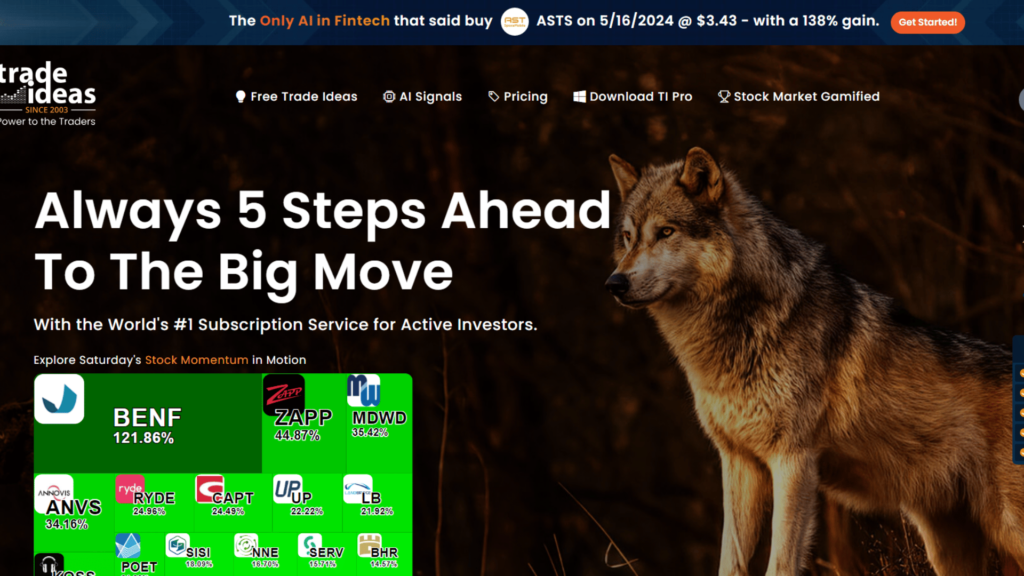

3. Trade Ideas

Trade Ideas is an artificial intelligence and AI-powered stock scanning and ideas generation platform designed for active traders and investors. At the heart of everything is Holly AI, a fully artificial intelligence engine scanning market data in real time to find hidden trading opportunities.

Trade Ideas uses machine learning algorithms to dynamically adjust to the changing market conditions and produce actionable trading ideas. Custom scanners, the ability to backtest, and risk-assessing tools, among many more, are Nd in.

Its AI-driven approach helps traders track momentum stocks, breakouts, and other trading opportunities that would have remained undetected with traditional modes of analysis.

Key Features:

- AI for automated generation of trade ideas

- Real-time scanning in stocks with customizable filter sets

- Backtesting and strategy optimization tools

- Integration with major brokers for automated trading

Pros:

- Extremely strong AI-driven stock discovery capabilities

- Suitable for day traders and swing traders

- AI model keeps evolving based on market conditions

Cons:

- The price is relatively high when compared to some of the competition

- Can be overwhelming for beginners due to a ton of features

- It needs active management and monitoring for the best results

Website: www.trade-ideas.com

4. Benzinga Pro

Benzinga Pro is an AI-driven, all-in-one platform of financial news and analytics designed to provide users with real-time market intelligence. While it is not exclusively an AI-based tool in itself, its inbuilt machine learning algorithms filter and rank news, detect events moving the markets and present them as sentiment analysis.

The AI capabilities of Benzinga Pro keep traders and investors ahead in markets through fast deep dives into relevant information. It offers customizable news feeds, real-time alerts, and integration with various trading platforms.

It is of special interest to event-driven traders and investors, where a fast reaction to the information-moving markets is needed. In such a scenario, AI-enhanced news analysis proves helpful.

Key Features:

- AI News Filtering and Sentiment Analysis

- Customizable Watchlists and Real-time Stock Alerts

- Audio Squawk for Hands-free Market Updates

- Integration with Major Brokers and Trading Platforms

Pros:

- Faster, more reliable news delivery with enhanced relevance through AI

- Intuitive interface with fully customizable workspaces

- Deep coverage of all types of asset classes

Cons:

- Premium features feel expensive for individual investors

- Less technically dense in terms of the analysis tools compared to specialized charting services

- Not too user-friendly for beginners.

Website: www.benzinga.com/pro

Suggested Read: Top 12 AI Tools for Finance

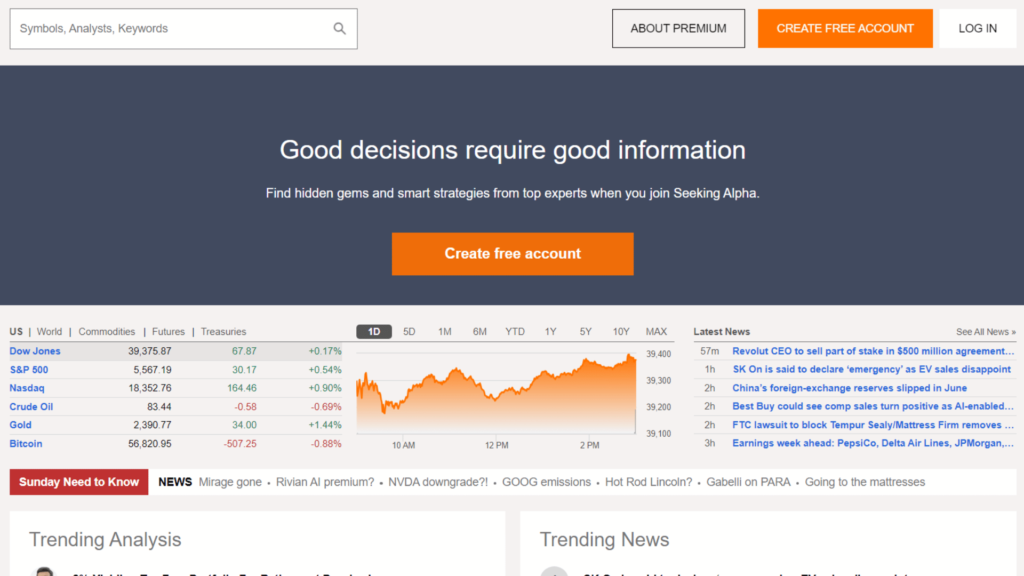

5. Seeking Alpha

Seeking Alpha is an investment research platform, crowd-sourced in terms of content and now integrating AI-driven tools to round out its peers. These algorithms sort shares, recommend rightly themed articles to users and generate quantitative ratings.

AI powers the offerings of Seeking Alpha—enabling users to find valuable insights amidst the cacophony of user-generated content and financial data. It assesses the different factors in a stock, thus giving an objective complement to the subjective analysis from its contributors under its Quant Ratings system.

While its web articles might be what comes to mind first, AI tools are ultimately what make Seeking Alpha a full-service stock analysis platform altogether.

Key Features:

- ratings that are AI-driven for the analysis of stocks;

- content personalization based on the preferences of individual users;

- sentiment analysis of articles and comments;

- earnings call transcripts that have AI-based key points extraction.

Pros:

- Diverse contributors offering diverse perspectives;

- AI-enhanced stock screener and rating system;

- great coverage of stocks, ETFs, and other assorted assets.

Cons:

- User-generated content variable in quality

- The priciest features are available through premium subscription only

- Potential for bias toward popular or spurious stocks

Site: www.seekingalpha.com

6. Thinkorswim

Thinkorswim by TD Ameritrade is an ultra-powerful trading platform harnessing technologies like artificial intelligence and machine learning. While it is best known for its more complex charting tools and options analysis, Thinkorswim has integrated features of artificial intelligence to boost its analytical capabilities.

The platform offers a variety of machine-learning algorithms for pattern recognition, risk analysis, and generations of trading ideas. The user can write the program code in the language of thinkScript to make his or her indicators or strategies that would fully employ AI capabilities.

The AI tools within Thinkorswim allow AI trader to analyze market trends, detect possible trading opportunities, and optimize trading strategies.

Key Features:

- Advanced pattern recognition with AI-enhanced technical analysis

- Risk analysis with probability calculations concerning trades

- Custom scanning capabilities for stocks, options, as well as futures

- Paper trading with AI-assisted performance analysis

Pros:

- Solid and able platform with heavy-hitting analytical tools

- Great options analysis capabilities augmented by AI

- Strong education mechanisms on board to teach the advanced features

Cons:

- A steep learning curve presented for new users

- Requires a TD Ameritrade account to unlock all its features

- Resource-heavy on older computers

Website: www.tdameritrade.com/tools-and-platforms/thinkorswim.html

7. Morningstar, Inc.

Morningstar is one of the more respected investment research firms that have integrated AI and machine learning into their analysis tools. Although not strictly an AI platform itself, Morningstar employs machine learning algorithms to underpin its quantitative analysis, fund ratings, and stock valuations.

Its AI capabilities process huge financial data to give more accurate and timely insights. On AI tools, the firm supports portfolio analysis, risk assessment, and investment recommendations.

What stands out on this platform would be the mutual fund and exchange-traded fund analysis, powered by AI for funds’ performance, holdings, and management effectiveness analysis.

Key Features:

- AI power-driven quantitative analysis of stocks and funds

- Machine learning-enabled risk rating and ranking

- Automated portfolio evaluation with asset allocation suggestions

- Natural language processing for analyzing financial reports

Pros:

- A very prestigious brand with a great reputation for high-quality research

- Very comprehensive coverage of stocks, funds, and ETFs.

- AI-enhanced tools complement traditional fundamental analysis

Cons:

- Premium features are too expensive for individual investors

- Long-term investing strategy does not match active traders

- AI functionality of some features is not as advanced as focused AI platforms

Website: www.morningstar.com

8. EquBot

The EquBot AI platform can help you determine if your alternative data is predictive and then incorporate it into your strategy.

EquBot is an advanced AI tool designed for stock trading analysis and idea generation. It harnesses natural language processing and machine learning algorithms to swiftly analyze market data and news, providing insightful recommendations and actionable insights for investors and traders.

Key Features:

- Sentiment Analysis: EquBot assesses sentiment using AI algorithms that analyze news and social media content.

- Technical Pattern Recognition: It identifies technical patterns and trends in market data, aiding in predictive analysis.

- Customized Watchlists: EquBot creates personalized watchlists tailored to individual user preferences, enabling efficient monitoring of specific stocks or sectors in real time.

Pros:

- EquBot uses AI and natural language processing to generate stock trading ideas.

- It offers 24/7 automated trading driven by quantitative algorithms.

Cons:

- EquBot charges subscription fees, which can be high if systems are prone to analysis errors.

9. Finviz

Finviz is mainly a stock screener and market research platform, made intelligent by the use of AI-based analytics. While not entirely an AI tool, Finviz does employ machine learning algorithms to enhance stock screeners, technical analysis, and market visualizations.

The artificial intelligence in the platform helps users correlate trading opportunities with market trends and better visualize huge financial information datasets. AI drives its heatmaps and sector performance tools, making it easy to present complex market activity in a graphical form.

The latter is favored by both less experienced traders and more professional ones due to its AI-enhanced screening and interface suitable for the majority of users.

Key Features:

- AI-based customizable filters for stock screening;

- Machine learning-enhanced technical analysis and charting;

- Chart analysis with the addition of automatic pattern recognition;

- Market sentiment analysis with news aggregation facilitated by AI.

Pros:

- Powerful screening and excellent data visualization;

- AI-enhanced visualization tools are top-notch.

- Sector and industry-level analyses are available.

Cons:

- Advanced features require a paid subscription

- Fundamental analysis tools are not as extensive as some of the competition

- AI capabilities are not as broad as those of focused AI platforms

Website: www.finviz.com

Suggested Read: Best 10 Affiliate Marketing Software for 2024

10. TrendSpider

TrendSpider is an advanced AI tool designed for stock trading and price prediction. It utilizes a sophisticated AI engine to analyze charts and technical indicators, generating automated trading signals and customized trading ideas aligned with your strategy.

Key Features:

- Examines custom indicators for buy/sell signals.

- Identifies reversal and continuation patterns.

- Triggers trade signals based on technical indicators.

Pros:

- Provides automated charting and analysis of stocks.

- Offers customizable scans and indicators for price/volume patterns.

Cons:

- Steep learning curve to master the platform.

- Offers limited technical indicators compared to competitors.

Website: www.ninjtrader.com

Conclusion:

The penetration of AI tools into stock market research has changed the way investors and traders look at financial markets. These 10 Best AI tools for Stock Market Analysis platforms offer their varied range of advanced charting, pattern recognition, sentiment analysis, and automated trading capabilities.

What each brings forth is individual strengths that can suit different investment styles or levels of expertise. Knowing when to buy or sell is therefore critically dependent on the timely arrival of such insights from the artificial intelligence system.

To this effect, while AI can do all kinds of wonderful things to bless us with valuable insights and automate some processes, it shouldn’t replace human judgment entirely. One’s best route is to mix the analytical strength of AI with the intuitive feel and experience of human investors.

FAQs

Are AI tools for stock market analysis suited to beginners?

Yes, most AI tools have user-friendly interfaces with learning resources suitable for beginners. Advanced platforms, however, can have a steeper learning curve.

Do AI tools guarantee profitable trades?

No. AI tools can never guarantee any sort of profit. They give an analysis and insight to help one in decisions, but market risks are always imminent.

Will I need previous knowledge to be able to put these AI tools into the service stock market?

Most AI stock market investment analysis tools require no previous programming knowledge; however, some advanced platforms do feature certain customizing options.

How much do AI stock market investment analysis tools cost?

The prices range from free basic versions to several hundred dollars a month for their premium packages. Prices are mostly tiered, working on the principle of what features and data access users have.