Your gateway to burdenless taxation. It’s like a magic wand to do away with all worries about GST. Wait in, we have something better: GST billing software! These digital wizards can liberate you from the clutches of mind-numbing calculations and the overwhelming amount of paper.

Be it a small shop owner or a big business tycoon, somewhere out the perfect software sidekick is waiting to join your financial adventure. In this article, we will count down the top 10 best GST billing software superheroes that can turn your tax nightmare into sweet dreams. Be prepared to meet the tools that will make you say, ‘GST? No sweat!’ Let’s enter that world where numbers are supposed to dance to your tune, and compliance is just one click away!

What does GST mean?

Goods and Services Tax (GST) is an indirect tax levied in India on the supply of goods and services from July 1, 2017. It subsumed several other central and state taxes, simplifying the overall tax structure and resulting in one uniform national market. GST applies to the supply of goods and services for manufacture, sale, and consumption.

What is a GST billing software?

GST billing software is an exclusively designed tool that enables businesses to generate invoices, manage inventory, and derive reports adhering to GST standards. Digital solutions automate various aspects of the billing process, ensuring accuracy in tax calculations and smooth filing of GST returns.

Why should businesses use GST billing software?

- Effectiveness: The GST billing software used by business owners keeps them updated on the latest rules and regulations for taxation implementation and helps minimize the risks of penalties or legal trouble.

- Accuracy: It involves complex tax amount calculation, which the software does with very few chances of differences in financial books.

- Reporting: The software generates many types of reports, making it easier to analyze business performance and tax liabilities.

- Integration: Most of these solutions are integrated with other business systems, offering a single platform for running businesses.

Features of GST billing software

1. Invoice generation: It generates GST-compliant invoices and automatically calculates the applicable taxes.

2. Inventory management: Track inventory levels and updates in real time.

3. Customer and vendor management: The software records all clients and suppliers in one database.

4. Tax calculation: Automatically calculate different synchronized components of GST, like CGST, SGST, and IGST.

5. Returns filing: The application helps prepare and file returns under GST.

6. Reporting: It generates financial reports and analytics.

7. Multi-user access: It has multiple team members, and all work simultaneously.

8. Cloud-based storage: Secure data can be stored in the cloud and accessed from anywhere.

9. E-way bill generation: One can generate e-way bills for the transportation of goods.

10. HSN code lookup: One can easily access the HSN codes of products through it. HSN Meaning: harmonized tax nacional System of Nomenclature)

Top 10 GST Billing Software

1. Zoho Books

Zoho Books is comprehensive accounting software that will fit into any business and be GST-compliant. The program has a user-friendly interface and a lot of characteristics to help run finances efficiently. Zoho Books automates a huge amount of accounting work, starting from step one—that is, the creation of invoices to the reconciliation of bank statements.

It provides real-time cash flow updates and your overall financial health to support prudent decision-making. It also supports multiple languages and different forms of currency working simultaneously, which is very suitable for any business carrying out operations overseas.

Key features:

- The reconciliation and feed of bank transactions is automatic.

- It enables sending invoices and getting paid instantly, as well as even customizing them.

- Accept and categorize tracking expenses.

- Multiple currency support.

- It is a user-friendly interface.

- It has good reporting ability.

- Excellent support system

How to use:

- Visit the Zoho Books website. Upon visiting, sign up for the.

- Set up your business profile along with your chart of accounts

- Begin creating invoices and handling transactions

Website: https://www.zoho.com/in/billing/

2. FocusLyte

FocusLyte is a GST billing, cloud-based software specially designed to cater to small and medium enterprises operating from India. It makes GST compliance and invoice management very simple. The software offers all the basic facilities to create GST-compliant invoices and maintains inventory with report generation.

It stresses simplicity of use so that even users with less accounting exposure can use it easily. It also provides multi-business location management and data import and export with complete ease. This software continuously updates the latest GST rules and regulations.

Key Features:

- Generate GST-compliant invoices.

- Basic inventory management

- Automatic calculations for GST

- Simple Reporting tools

- Pocket-friendly price

- Non-accountants find it user-friendly

- Compliance updates regularly

How to Use:

- Log on to the FocusLyte website to create your account

- Fill in all your business details and preferences

- Start raising invoices and managing your GST compliance

Website: https://www.focuslyte.in/

3. Saral GST

Saral GST lives up to its name by providing one with a simple, efficient solution for compliance under GST. It caters to all sorts of small, medium, or large businesses. The software offers an integrated package of tools that are needed to file GST, generate invoices, and prepare returns. A standout feature of Saral GST is the user-friendly interface and easy follow-ups throughout the GST process.

It offers robust data security for the confidentiality of sensitive financial information. It provides detailed analytics and reports that help businesses understand their tax liabilities and, hence, their financial performance. So, without a doubt, the best and most impeccable GST tool a business should have is Saral GST.

Key Features:

- Automated filing of GST returns

- Real-time tax calculation

- Comprehensive compliance checks

- Detailed analytics and reporting

- User-friendly interface

- Strong compliance engine

- Widespread reports

- Excellent customer support

How to Use:

- Register on the Saral GST website.

- Onboard on the website with business details from the user:

- Use the software for all requirements concerning compliance under GST and Invoice.

Website: www.saralgst.com

4. CaptainBIZ

This is an all-around GST billing software named CaptainBIZ, entailing a host of features to assist in running business operations seamlessly. The system is more than compatible with GST as it has inherent facilities to manage inventory, customers, and financial reports. The software is equipped to handle different industries with tailor-made solutions to meet every business’s needs.

CaptainBIZ ensures data security by having all data regularly backed up and encrypted to protect it against exposure and ensure the safety of sensitive information. It provides multi-user access and usage, especially when different teams work online to surmount the business’s financial requirements.

Key Features:

- Integrated CRM and Inventory Management

- Multi-User Access with Role-Based Permissions

- Customizable Dashboard and Reports

- Automated GST calculations and filing

- Comprehensive business management features

- Industry-specific customizations available

- Strong data security measures

How to Use:

- Sign up for an account on the CaptainBIZ website

- Configure your business settings and preferences.

- Start working with different modules like GST, inventory, and CRM

Website: www.captainbiz.com

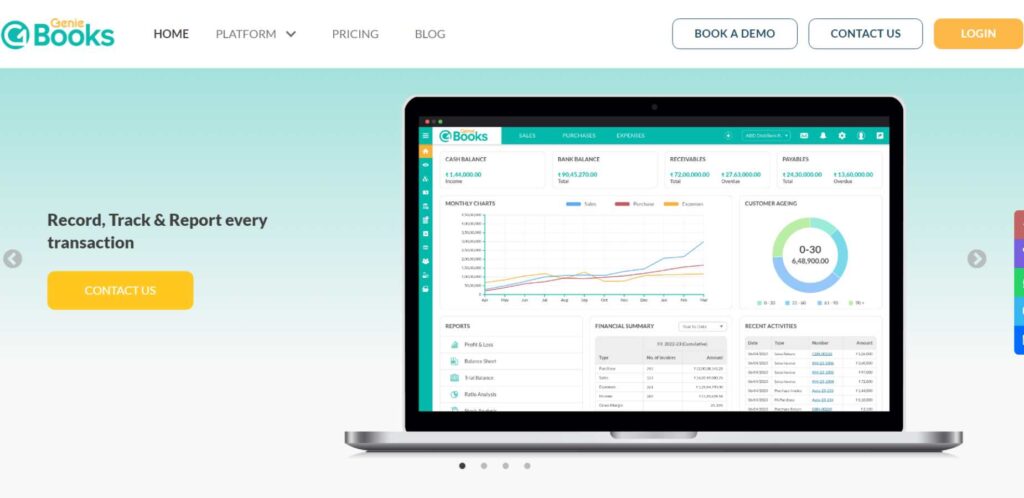

5. Genie Books

Genie Books is cloud-based GST accounting software designed to simplify financial management for small and medium enterprises. It is very user-friendly. Its intuitive user interface with drag-and-drop usability allows it to be used with minimal accounting. It has extensive tools to create invoices, track expenses, and be GST compliant.

The key differentiator in Genie Books is its AI-powered features: auto-categorization of transactions and predictive analytics. The product allows smooth integration with bank accounts, thereby tracking all finances in real-time. It also offers business-specific customizable reports and dashboards for insights into the current financial health of a business at a glance.

Key Features:

- Transactions can be categorized through artificial intelligence.

- Bank reconciliation can be automated.

- Flexible invoicing by creating templates of different sizes.

- Real-time reports on your finances

- Easy to use drag and drop UI

- AI-based high-end features that make it very automated

- Comprehensive GST compliance tools

How to use:

- Subscribe to the service on the webpage of Genie Books

- Connect all your bank accounts and import all past data

- Use the software to issue invoices, track expenses

Website: https://geniebooks.com/

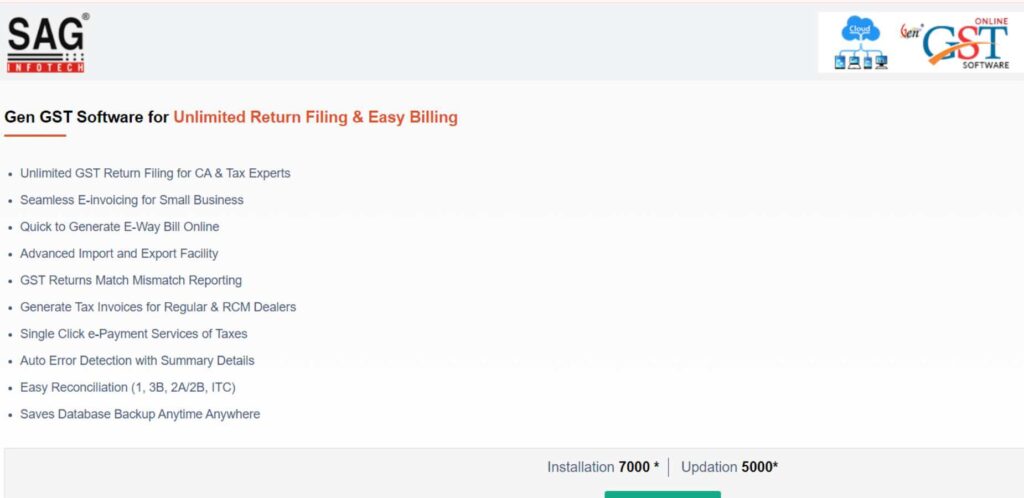

6. Gen-GST

The Gen-GST software is highly efficient in GST billing software design for businesses looking for an end-to-end solution in compliance. With a host of features, it ensures the whole GST process is a cakewalk and does not consume much time, from invoice generation to return filing. Its advanced analytics tools make software incomparable with minute details on tax liabilities and performance.

Gen-GST emphasizes the accuracy of the inbuilt validation checks, thereby ensuring error-free GST filing. It offers multi-branch support, making it efficient for any business with multiple locations. This software supports updating processes to keep up with changing GST rules for continued compliance.

Key Features:

- Advanced analytics and reporting

- Multi-branch support

- Inbuilt compliance validation checks

- GST returns are prepared automatically

- All-rounded compliance features

- Detailed financial analytics

- Prompt notification on any change in the law

How to Use:

- Register as a seller/account on the web platform of Gen-GST

- Register your business profile and update the details required on the Gen-GST platform as you desire.

- Start using the software for doing GST billing and compliance

Website: https://saginfotech.com/gst-software-amp/

7. uBooks

GST billing software for uBooks is a simple and easy program for all related operations to billing under GST. This is made up of the minds of small businesses and start-ups looking for a compact program that can ease doing business in terms of GST compliance and basics. UBooks follows a simple and clean interface and requires very little or no training in its navigation.

UBooks offers the basic requirements of any invoice—making invoices, maintaining expenses, and GST calculations. The features that make this one stand out include the price and clean pricing model. The tool does allow for essential inventory management since it serves basic stock requirements of businesses.

Key features:

- Easy to create an invoice

- Simple Checking

- Automatically calculate GST

- Store data on the cloud

- User-friendly

- Very affordable pricing

- Good for a small business with primary needs

How to use:

- Register on the online site.

- Create a new business account with as many details as you can

- Start creating invoices and managing your GST compliance

Website: www.ubooks.in

8. Just Billing

Just Billing is a versatile GST billing software that is marvellously simple and powerful at the same time. It has a perfect blend of features ideal for all types of business entities, from small-scale retail shops to medium-scale firms. With a whole host of tools ranging from billing to inventory and extended to GST, this software is promised.

Above all, Just Billing stands out with its offline features while guaranteeing continuity in its operations even when the internet is down. It is loaded with strong reporting that unravels sales trends and the business’s financial performance. There is also support for multi-users and device access for general workflow collaboration.

Key Features:

- Offline billing functionality

- Advanced inventory management

- Multiple users with the same license across devices

- Customization to a wide range of businesses

- Dual functionality

- Great reports tool

- Suitable for a wide range of businesses

How to Use:

- Download and install by securing a copy from the original website.

- Set up a business profile and configure it according to your needs.

- Start Billing, Inventory, and GST Business

Website: www.justbilling.in

9. MyBillBook

MyBillBook is truly on-the-go, mobile-first GST billing software for small to medium businesses. It is extremely simple to use on smartphones and specifically designed to run on tabs, desktops, or laptops, making it highly flexible in its working environment. It offers must-have features for creating invoices, expense tracking, and necessary GST compliance.

Regarding mobility, MyBillBook stands out seamlessly with its fully-fledged mobile app, permitting businesses to manage their finances on the go. It also updates the inventories and sales report in real time, which can help make quick decisions.

Key Features:

- Full-featured mobile app.

- Real-time inventory and sales tracking.

- Multi-language support.

- Simple GST return filing assistance.

- Excellent mobile functionality

- Clean and user-friendly interface

- Support for regional languages

How To Use:

- Download the MyBillBook app from your device’s app store.

- Register your account and enter your business details.

- Begin using for billing, inventory, and management of GST

Website: https://mybillbook.in/

10. Cygnet GSP

Cygnet GSP is deep GST Suvidha Provider software that offers end-to-end GST compliances. It caters to businesses of all sizes, from small enterprises to large corporations. The software has many inbuilt features, such as invoice generation, return filing, and e-way bill creation.

Cygnet GSP is unique in that it deals directly with the government’s GST portal, which ensures real-time compliance and accuracy of data in the returns. It also has advanced analytics and reporting features that offer deep insights into tax liabilities and compliant status.

The software includes multi-GSTIN management, so it benefits businesses with many branches or entities.

Key Features:

- Integrated with the Government GST Portal

- Proactive analytics and compliance system

- Multi-GSTIN Management

- API Integration

- Comprehensive compliance features

- Scalability for businesses of all sizes

- Real-time data synchronization with the GST Portal

How to Use:

- Visit the Cygnet GSP website and sign up for an account.

- Complete the onboarding process and, subsequently, verification of GSTIN.

- Start using the software for compliance and reporting purposes.

Website: https://www.cygnet-face.com/pricing/

Suggested Read: Payroll Software for Small Business

Conclusion

Indeed, at the end of this synthesized study of the 10 best GST billing software, one thing is certain: there is a perfect solution for every business. Every software makes a notable difference, whether the user-friendly uBooks or the all-encompassing Zoho Books.

Remember, the best one for you depends on your specific needs. Consider factors like the size of your business, budget, and important features. Whether you need simple invoicing or advanced analytics, there is a tool that will help make your GST compliance easier.

Suggested Read: HR Management Software

FAQs:

Can I use GST billing software on my smartphone?

Yes, lots of them; for example, MyBillBook provides full-featured ones.

Do these software come with working offline features?

Yes, some, like Just Billing, are offline working, providing seamless operations.

Does the GST software help with business multi-locations?

Yes, most, including Cygnet GSP, provide multi-GSTIN support.

Is GST billing software valid for small businesses?

Yes! In fact, most products, such as uBooks and FocusLyte, are explicitly for small businesses.