The money world of finance still undergoing serious reformation resulting from the rapid development of artificial intelligence technologies. AI tools have grown to be more and more important in the field of finance as businesses and financial institutions continue to strive for efficiency, seeking to drive down costs and remain competitive in the current date.

In this article, we will learn about the top 12 AI tools for Finance that have revolutionized the financial sphere. Before dipping into the very concept of the abovementioned, we first explain what AI tools for finance are and how they disrupt the usual course of financial service activity.

What are AI tools for Finance?

Advanced analytics financial tools are software applications and platforms that work with AI- and machine learning-based algorithms to pre-program, optimize, and execute numerous finance functions and decisions in an automated way.

A few such AI Tools for Finance have been designed and are available to financial professionals and institutions to help in the analysis of enormous numbers of data so that they can observe patterns and make further predictions that help them move forward into better decision-making processes.

AI finance tools can now be a part of banking risk management and may seek insights on the assessment and prediction of potential risks through historical data analysis and market trend reviews. This provides them with better judgment in granting loans and investments, among other financial instruments:

- Fraud Detection: This machine learning can detect any unusual pattern and behavior that may indicate fraud, making it possible to find the actual place where financial crimes are being conducted much faster and with greater accuracy.

- Algorithmic Trading: Automated AI-based trading systems operate in real-time data analysis and launch profitable, defined, and pre-determined mostly strategies at speeds and volumes beyond human traders.

- Personal Finance Management: AI-fueled apps and chatbots for providing personalized advice on personal finance, budgeting, optimization of expenditure, and saving habits.

- Credit Scoring: AI models shall remain better equipped to handle more widely propagated creditworthiness factors than ever in the history of model populating through traditional means.

- Customer Service: Chatbots are AI finance assistants that can respond to customer queries, share their account information, and even support basic transactions. In this way, they enhance the general customer experience and reduce the operational costs

Why You Need AI Tools for Finance

1. Better Decision Making

The AI Tools for a Finance Professional can accommodate and process huge volumes of data while simultaneously identifying the patterns that, at times, escape the comprehension of human eyes. It makes the process of decision-making much more effective since it enables one to make better decisions over investment strategies and better actions on the risks and credits.

2. Enhanced Efficiency and Productivity

AI Tools for Financial Analysts take in routine processes, making the precious time of the financiers available for other more strategic and value-added work, thereby reducing costs significantly and improving productivity.

3. Better Control Over Risk

Artificial intelligence (AI) in finance can mine historical data and market trends for potential risks better compared to the available methods. Better capabilities for assessing and analyzing a more effective level of risk enable financial institutions to be able to pass informed judgments and enforce risk mitigation.

4. Fraud Detection and Prevention

Finanace AI machine learning models recognize patterns and behaviors that may lead to fraud activities. Such a system identifies and prevents financial crimes at an extremely fast rate and far more accurately as opposed to manual ways.

5. Personal Customer Experience

With artificial intelligence tools, financial institutions can provide services and offers to individual customers based on their data, which can increase satisfaction and loyalty.

6. Up-to-date Market Analysis

These ai machine learning finance tools will do real-time analytics on market data, sentiments from news and social media, etc., considering them as valuable inputs that could be useful for both traders and investors. This is one method of doing so. This would be one of the very important capabilities, especially in this fast world of financial markets where time is very little.

How to Select the Right AI Tool for Finance

Assuring the selection of the right AI tool for one’s financial needs will significantly guarantee the full benefits accruing from its application, thus guaranteeing successful implementation. Here are the key considerations to make in the choice of an AI-powered financial analysis tool targeted for finance.

1. Identify Your Specific Needs

Define clear, unambiguous problems or processes to be solved or improved so you can focus on tools that are specific to your definition’s problem.

2. Data Compatibility and Integration

Ensure the AI tool is compatible with your current systems and integrates sources of data. They should be able to handle the kind of data you handle every day.

3. Scalability

Choose a tool that can grow with your organization even as the volumes and complexity increase.

4. Accuracy and Performance

Opt for tools that are well-established and proven to be both accurate and reliable. Case studies, client testimonials, performance metrics, and stats provide good insight.

5. User-Friendly

User Friendliness – The AI tool should be such that it is easy to use and intuitive, even to team members without much of a technical background. A user-friendly interface will help in promoting the tool within the organization, considering it is of high value.

6. Customization

Every financial institution will certainly have its unique needs. Go for a tool that allows options for customization in developing a solution that is tailored to those particular unique needs.

Top 12 AI Tools for Finance

1. Sage Intacct

Sage Intacct is an AI tool for financial success, cloud-based finance management software. It delivers in-the-moment management and operational insight to drive better, data-driven decisions.

The software brilliantly supports multiple entities, and multiple native currencies, and is very suitable for companies using the franchising model, companies deploying a multisubsidiary model for regional expansion, and entities requiring a complex financial model that is growing.

On top of this, Sage Intacct is also driven by AI since automation also gets rid of repetitive operations to ensure an increased level of accuracy and predictive analytics that will guarantee that financial forecasting is even more precise.

Key Features

- Automated finance by AI

- Real-time reporting and dashboard

- Management across multiple entities and currencies

- Ahead-of-financial times predictive analytics

Pros

- Automates complex finance operations

- Real-time financial insights

- Scalable as your business grows

Cons

- Complex for a small business

- Will require hefty setup and training.

- Higher rates compared to simple accounting software

Pricing: Based on the service the business needs

Website: www.sageintacct.com

2. Oracle Netsuite

Oracle NetSuite is an independent provider of AI-driven financial management with AI-driven financial management software. In the cloud-based overall business management suite, inventories, finances, commerce, and CRM are all integrated into one system for its customers.

Among the features of Netsuite AI include Spearhead automating financial processes and anomaly detection, and delivering predictive insights to its customer companies among many others.

Key Features:

- AI-drive Financial Planning and Analysis

- Automated revenue recognition and billing

- Intelligent cash management

- Predictive supply chain management

Why We Chose It:

- Comprehensive suite covering most needs

- Good support for global, multi-subsidiary operations

- Truly scalable

Potential Drawbacks:

- Can be a bit overwhelming to smaller businesses

- Complex and expensive to customize

- Needs a heavy investment in implementation and training

Pricing: Based on modules and business size

Website: www.netsuite.com

3. QuickBooks

QuickBooks is a prominent accounting software, already incorporating AI in its transactions. Designed with versions that target small-sized to medium-sized enterprises, it has cloud choices or just a desktop version.

QuickBooks is turning to AI to automate stuff like data entry, and categorization of transactions, and may even provide cash flow predictions. With a vast number of integrations possible and user interfaces that are extremely user-friendly, it remains very flexible and suitable for many companies.

Key features:

- AI-based expense categorization

- Automatic matching and reconciliation of the invoices

- Cash flow projection and intelligence

- Wise reporting with custom dashboards

Why Use It:

- A very easy dashboard so user-friendly — even for a layman, not an accountant

- Pricing is very nominal, and it is the best value for a smaller concern

- A very large colleague of apps and integrations

Why Not:

- It fits best with much complexity and very large enterprises.

- Not as flexible or customizable as enterprise-class solutions

- Some advanced features are available only in premium plans

Pricing: $25/mo starting plan- Simple Start edition

Website: www.quickbooks.intuit.com

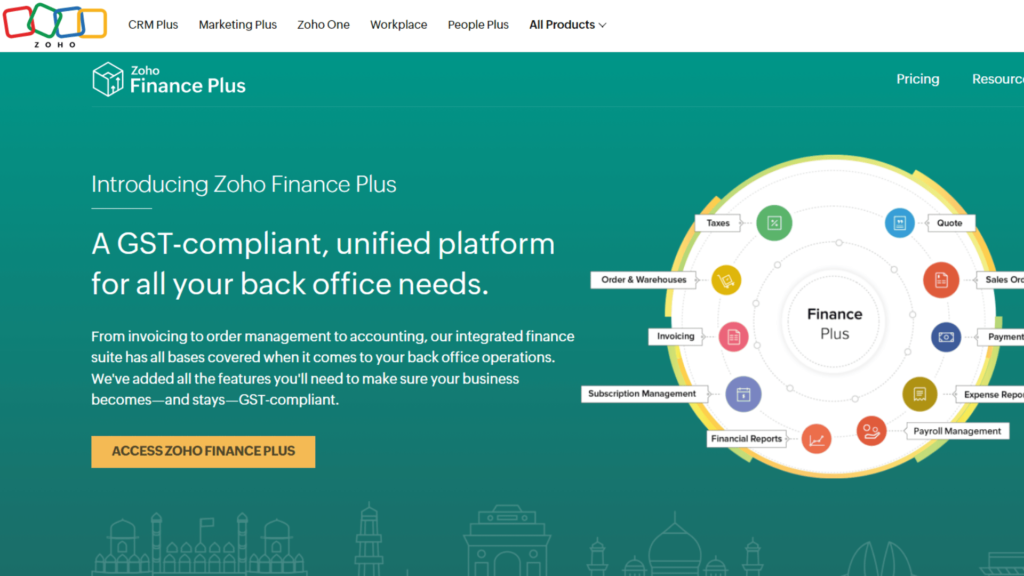

4. Zoho Finance Plus

Zoho Finance Plus is an integrated finance suite powered by an artificial intelligence layer for the automation of financial operations, accounting, invoicing, inventories, and expense tracking.

With artificial intelligence at the base of Zoho Finance Plus, data are recorded through an intelligent mechanism of cash flow to derive better insights or decisions across the financial aspect. More so, it is suitable for the small- to medium-sized business fraternity that urgently needs a complete solution for financial management.

Key Features:

- AI-driven data capture and entry

- Smart, automated cash flow forecasting

- Automated bank reconciliation

- Predictive analytics to allow for financial planning

Why to buy:

- Ability to handle any financial controls

- Native integration capacities with other Zoho software

- A low-cost solution for small business

Drawbacks:

- It is not so powerful compared to other enterprise solutions.

- Not much can be customized

- It seems you need to use at least two to three Zoho finance products to get half the functionality.

Pricing: from $249/month for 10 users

Website: www.zoho.com/finance-plus

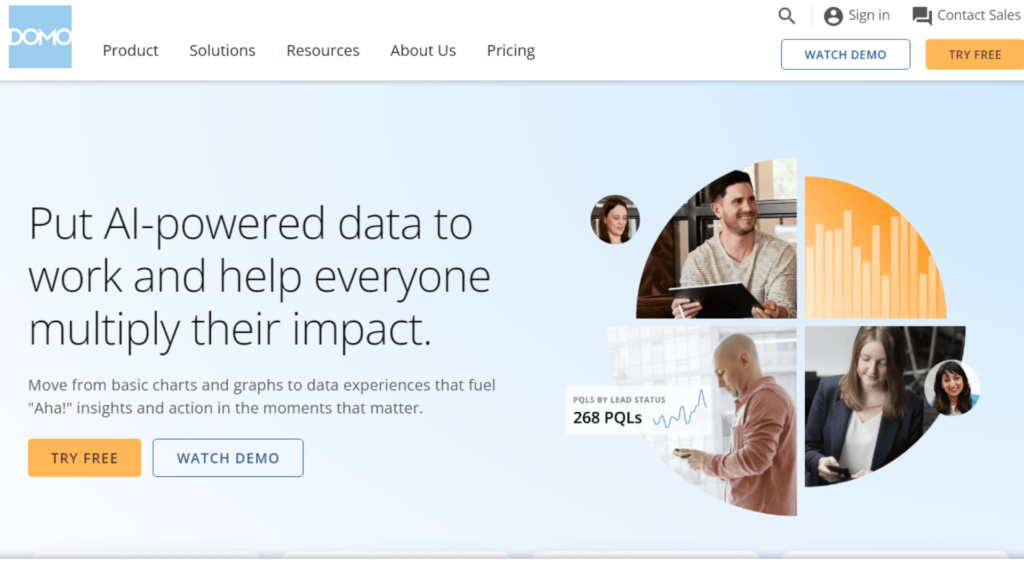

5. Domo

Domo’s infrastructure is powered by artificial intelligence financial analytics and reporting within a cloud-based business intelligence platform. It can work with data visualization expertly, thereby coming up with real-time dashboards for quickly capturing complex finance data by finance professionals.

The advanced AI, together with visualization, leads to the accomplishment of capabilities in predictive analytics through anomaly detection and natural language requesting.

Key Benefits:

- AI-Based Predictive analytics

- Real-time data visualization

- Natural Language Querying

- Automated Alerts and Notifications

Pros:

- Advanced data visualization features

- Data integration from different sources

- Interface that is very easy and intuitive to use for any nonspecialist

Cons:

- Expensive for small businesses

- Data requires preparation for better fitting

- Complex setups might require professional services

Pricing: Customized based on business requirements

Website: www.domo.com

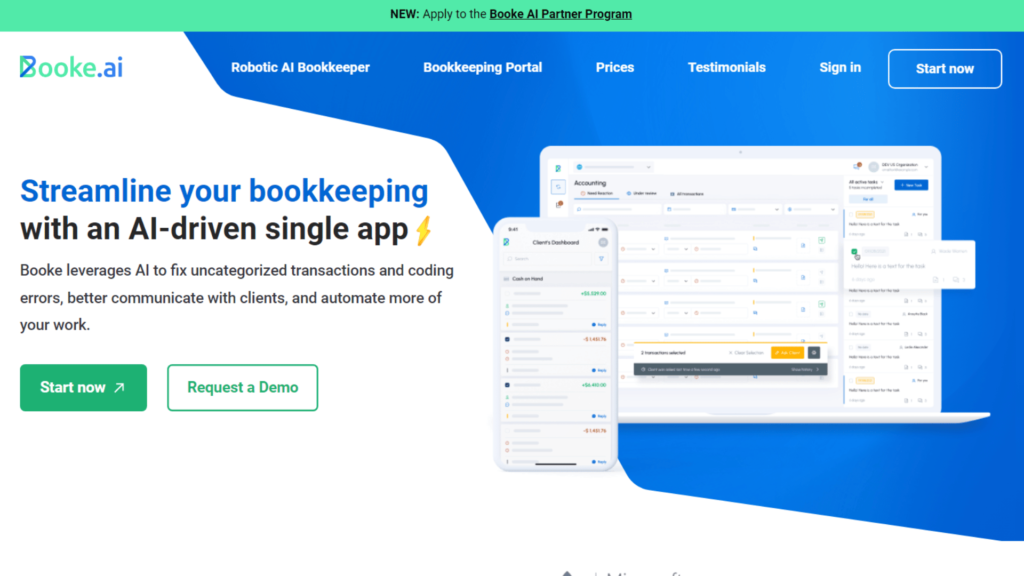

6. Booke.AI

The technology behind the application enables the ability to categorize each transaction via machine learning-powered algorithms, which greatly automate the entries and account reconciliations.

Booke.AI works for small businesses and midsize enterprises looking to cut time for human resources around regular bookkeeping work. It includes the automated categorization of transactions, invoice matching with AI, intelligence-powered bank reconciliation, and detection of anomalies in financial data.

Pros:

- Much time spent manually in bookkeeping by an individual is saved by buying the product.

- Promises higher accuracy of the records

- Integrates with many popular bookkeeping software

Cons

- Requires training phase to reach maximum accuracy

- Specific to the bookkeeping only

- This cannot be applied to businesses that have too complicated a financial structuring

Pricing: Custom pricing based on the number of your transactions

Website: www.booke.ai

7. Stampli

Stampli is an AI accounts payable platform designed to automate the invoice processing workflow. A machine learning platform captures invoice data and then routes it for approvals and payment.

Stampli AI, or “Billy the Bot,” learns the organization through user activity around the invoice data flow. It takes off all the routines and potential issues on invoices in an automated manner to improve productivity, reduce errors, and provide better insights into the accounts payable process.

Key Features:

- AI-powered invoice data capture

- Smart approval routing

- Automatically detect duplicate invoices

- Real-time spend analytics

Pros:

- Greatly reduce manual work related to AP

- Highly accurate to mitigate the risk of errors

- Enhances the visibility of cash flow

Cons:

- Predominantly focused on accounts payable

- Need to integrate with certain other financial systems

- Can be expensive for very small businesses

Pricing: It depends on the volume of invoices; the pricing amount is available on the website.

Website: www.stampli.com

8. Nanonets

Nanonets is a very useful document processing platform, powered by artificial intelligence, which most specifically works well in cases regarding financial documents.

It uses machine learning and OCR technologies to parse the data of documents like invoices, receipts, and bank statements. Nanonets do automatic data entry, categorize expenses, and, finally, sync with accounting software.

Though not a complete financial tool, what is outlined above makes it highly competitive in most, if not all, of the financial processes.

Key Features:

- OCR to extract data

- Automated Classification of Documents

- Train an AI model

- API to enable seamless integration into your workflow

Pros:

- Eliminates operations, that are a manual process

- If os incredibly very highly configurable for training for a specific set of document type

- Takes over natively within your current systems and finances, thereby making sure there aren’t any double handling or entry of the same data

Cons:

- Requires setup and training for it to bring the best results

- It does not fully stop for financial holistic management

- In some of the cases, it may be necessary to have technical resources to be able to fully work on tailored needs

Pricing: From $499 per month billed annually for the Growth Plan

Website: www.nanonets.com

9. Planful

Planful Analytics is cloud-enabled financial budgeting, forecasting, and reporting software enhanced with Artificial Intelligence.

It has artificial intelligence features for continuous planning, meant to enable the finance team to provide appropriate and timely responses to business conditions that change significantly compared to the previous projections.

This Planful software automatically detects trending data, finds leading indicators, and consolidates data in a way that is insightful for better financial planning.

Key features:

- AI-driven financial forecasting

- Automated data consolidation

- Dynamic planning and modeling

- Intelligent anomaly detection

Pros:

- Simplifies the entire budgeting process.

- Forecast and forecast with high accuracy

- no more forecasting effort doing guesswork.

- Highly flexible for many different planning scenarios.

Cons:

- It is advanced and might not be needed for small organizations.

- The cost of setup and configuration could be high.

- For full use, other systems may need to be integrated with its planning capabilities

Pricing: Quoted for the business

Website: www.planful.com

10. Trullion

Trullion is an AI-powered financial automation platform for lease accounting and revenue recognition. It harnesses machine learning to facilitate automated data extraction from financial documentation, providing real-time financial insights with enforced compliance with accounting standards like ASC 842 and IFRS 16.

It’s private companies making big bets on growing their footprint who will get the most mileage from Trullion—especially those with lease arrangements that are complex and stacked, or conversely, those with complex revenue recognition scenarios.

Key features:

- AI-powered lease extraction and management process

- Automated compliance with accounting standards to be used in the financial disclosure process

- Real-time financial reporting

- Audit trail and version control

Pros:

- Elimination of complex accounting processes

- Compliance with current available accounting standards

- Decreases manual errors in the financial reports

Cons:

- It is limited as it only does lease accounting and revenue recognition.

- May require integration with another available financial system.

- The solution can be complex for companies with simpler financial structures

Pricing: By quote

Website: www.trullion.com

11. Vena

Vena is an AI-powered financial system. It supercharges your usual Excel with power and flexibility. It provides advanced budgeting, forecasting, and reporting enriched with power innovation based on machine learning.

Now, listen Vena AI does data aggregation all by itself, it also offers predictive analytics giving intelligent insights for better decision-making.

So the secret sauce is that it lays on top of Excel an AI capability, so it can be accessed by finance professionals who are used to working within the Excel-based workflow.

Key Features:

- AI-Enhanced Excel-Based Planning.ie. AI Excel formula generators

- Automation of data integration and consolidation

- Predictive analytics in forecasting the future

- Intelligent workflow automation

Pros:

- The raw performance of AI combined with the familiarity of Excel

- Simulation of complex financial processes in one single place

- Flexible modeling and scenario planning

Cons:

- This may result in high reliance on spreadsheets

- Could be too complex for people new to Excel

- AI must be configured well for the most immersive experience

Pricing: by quote Based on the Business Requirements

Website: www.venasolutions.com

12. Macroaxis

In investment management and analysis for the layman as well as the financial expert, Macroaxis uses AI for more than natural learning. It interprets markets, predicts the risks, and advises on the investments to take up.

It helps in traveling and managing the portfolio, supports AI integration in several optimization techniques about portfolios, and also involves the process of risk assessment for various markets.

This will not be very useful for the tools of corporate finance; rather, it is appropriate in matters related to investment financial activities.

Key Features:

- Portfolio optimization driven by AI

- Automatic risk assessment

- Market analysis prediction

- – Personal investment recommendations

Pros:

- Very powerful tools for analysis in investing

- Personal investing strategy

- Manage your investment portfolio for optimal efficiency

Cons:

- You might find it quite focused on the investment management part

- This probably means this tool is far too cunning for newbies

- You might want to be very cautious with some of the insights from AI

Price: Free basic version. Premium plans start at $19.95/month

Website: www.macroaxis.com

Suggested Read: Best 10 Affiliate Marketing Software

Conclusion

These 12 AI-based tools for finance vary from accounting and financial planning to investment management and document processing. Anytime you decide to use a tool from the 12 listed AI-based tools for finance, make sure the selected tool can meet your specific need. Consider the ease of using the tool, the integration possibility of the tool, and its overall cost-effectiveness to your organization.

Suggested Read: 15 Best Dropshipping AI Tools and Software

FAQs

What is the best AI tool for accounting, especially for a small business?

Most small businesses favor Intuit QuickBooks; it has a friendly user interface with AI capability for the automatic compendium of expenses.

What is the top AI tool in financial planning and analysis?

Planful (formerly Host Analytics) is the top for having time-driven AI forecasting and continuous planning.

Any AI tool you recommend that can be easily integrated with the financial process based on Excel?

Vena. It offers AI, and hence any finance professional, comfortable with a spreadsheet-based workflow, will like it very much.

What popular automation do you see out there in the accounts payable area?

Stampli. This has its reputation for streamlining the invoice processing and approvals that your AP system goes through.

What are some common AI tools for finance?

Some common AI tools for finance include predictive analytics software, algorithmic trading platforms, and robo-advisors. These tools leverage artificial intelligence to analyze data, make predictions, and automate financial decision-making processes. example finance ai GPT.